JMMB Merchant Bank Home Equity Loans Grow by Over 400% Business

Table of Content

Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower requirements and other attributes. When determining if a self-employed individual qualifies for a mortgage, we look at the person’s credit history, which is represented by a score, and the person’s ability to repay. The ability to repay is determined by adding the proposed mortgage amount to your existing loans. The total monthly repayment should not exceed 45% of your income. Speak to a mortgage adviser for special rates that may exist.

If so, then it likely will be unrealistic to expect to be better off when you increase your debt by 25%, plus interest and fees. This could become a slippery slope tobankruptcy andforeclosure. Home equity loan amounts are based on the difference between a home’s current market value and the homeowner’s mortgage balance due. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014.

How much home equity loan can I get?

May offer you a low introductory rate, which is ideal in a high-rate environment, as well as rewards program benefits. But your credit card interest rate could be high -- the current average rate is almost 20% -- if you don't already have solid credit. Should you want to relocate, you might end up losing money on the sale of the home or be unable to move. And if you’re getting the loan to pay off credit card debt, resist the temptation to run up those credit card bills again.

If the person is self-employed and in good health and does not have a physically taxing job, for example, a lawyer, the loan may be calculated to end at age 70. For employed persons, the loan is calculated to end at age 65. For an SBA 7 loan, an SBA lender may charge a prepayment penalty along with closing costs, late payment and referral fees. They can also charge a packaging fee of up to $5,000 for putting together your loan documents for the SBA to review. However, they are prohibited from charging origination fees and application fees. You should avoid using a home equity loan or HELOC to start a business if you have other financing options that don't involve using your home as collateral.

Rate review: How mortgage interest rates have moved

TD Bank home equity loans are only available in about 16 states. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek an accommodation, please let us know.

"Home equity borrowing is no longer a low-cost source of funds," cautions McBride, who notes that HELOC rates are near 15-year highs. McBride also notes that as the prime rate rises above 7%, the variable rate is likely to increase further. "The cost of this borrowing is greater than we've become accustomed to, and so, too, is economic uncertainty. That's not a good combination," he says. Plus, as rates have crept up in the past year, home equity loan rates are no longer enticingly low, making them a less valuable financing option.

Example of a Home Equity Loan

If your business fails and you can't pay back your loan, you could lose your house to foreclosure, which is why there are better alternatives to fund the start of your business. Marc is senior editor at CNET Money, overseeing banking and home equity coverage. He's been a financial writer and editor for more than two decades, working for The Kiplinger Washington Editors, U.S. News & World Report, Bankrate and Dow Jones. Before joining CNET Money, Wojno was Senior Editor of Finance for ZDNet, writing on blockchain, cryptocurrency, financial services, investing and taxes.

The max is prime plus 6.5 percent for loans of $50,000 or less, and Prime plus 4.5 percent for larger loans. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

We also graded them based on credit access and speed to close as well as whether they offer low fees or discount promotions. Closing costs range between 2% and 5% of the loan amount, which is typically lower than closing costs on a purchase mortgage and even slightly lower than closing costs on a cash-out refinance. Compare rates, fees and repayment terms on lender’s Loan Estimate. Our estimate for the 2023 Financial year-end eps, considering the growth in the first quarter of the financial year and seasonality of earnings amounted to $5.95.

Legal fees cover a wide variety of legal needs such as representation, drafting of the sales agreement, and writing letters to utility companies regarding name changes, etc.

Generally speaking, when the economy is strong, more people buy homes. The opposite is also true; less demand can lead to lower rates. Mortgage rates have been on a wild ride as of late, with the 30-year fixed now past the once-unthinkable threshold of 7 percent as the Federal Reserve cracks down on inflation. Does state that rates are pegged above current market rates for 5- and 10-year U.S.

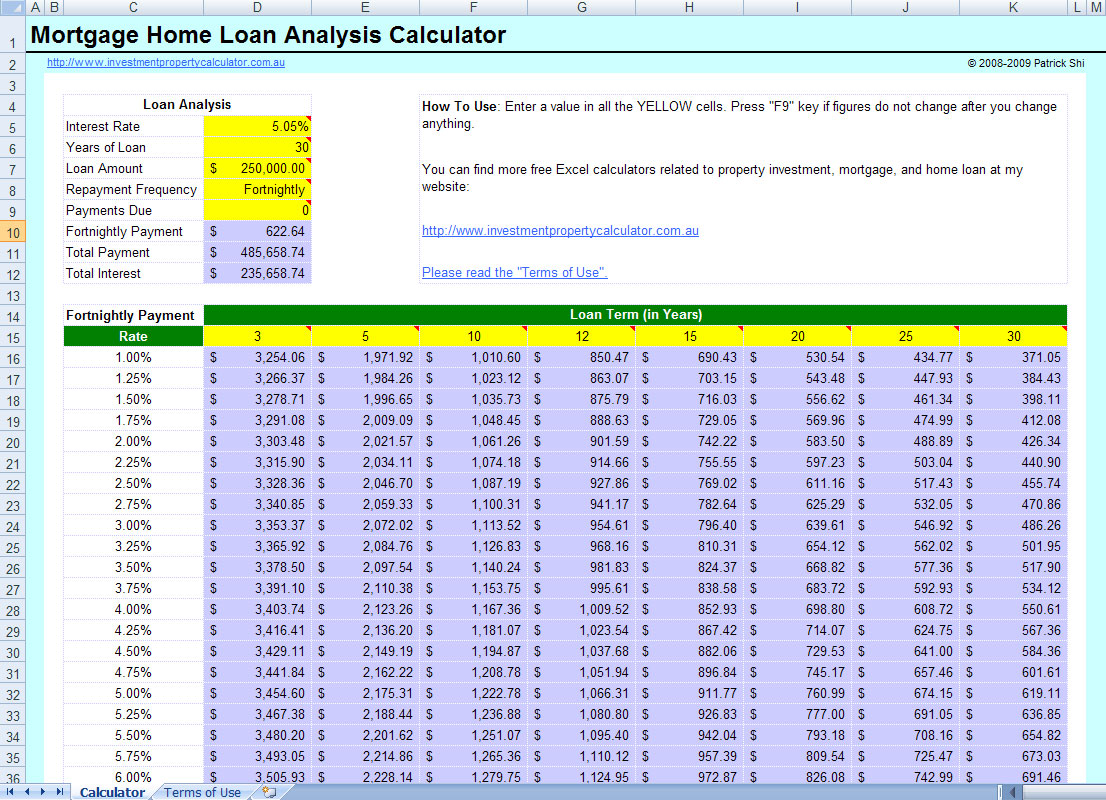

Shop around and talk to at least two to three lenders about a home equity loan, and compare the overall cost for each loan to find the one that makes the most financial sense for you given today’s rates. When your old home sells, the proceeds will first pay off your remaining mortgage balance, then your home equity loan. Repayment of a home equity loan takes anywhere from five to 30 years, but the most common home equity loan term is 20 years. Talk to your lender to decide on a repayment term that works best for you. The rate at which the mortgage is calculated is not dependent on the status of the applicant’s residency.

Consolidating that debt to a home equity loan at a rate of 4% with a term of five years would actually cost you more money if you took all five years to pay off the home equity loan. Also, remember that your home is now collateral for the loan instead of your car. Defaulting could result in its loss, and losing your home would be significantly more catastrophic than surrendering a car. Home equity loans provide a single lump-sum payment to the borrower, which is repaid over a set period of time at an agreed-upon interest rate. The payment and interest rate remain the same over the lifetime of the loan.

The loan must be repaid in full if the home on which it is based is sold. Essentially, a home equity loan is akin to a mortgage, hence the name second mortgage. The amount that a homeowner is allowed to borrow will be based partially on acombined loan-to-value ratio of 80% to 90% of the home’s appraised value. Of course, the amount of the loan and the rate of interest charged also depend on the borrower’s credit score and payment history.

You can call us or book an appointment through our website and a mobile loans officer will visit you at your convenience to assist you with the process and to answer your questions. It means every payment you make goes towards settling interest and reducing your principal balance. The interest is computed based on the principal balance remaining after each payment is made.

Mortgage “points,” or loan discount points, are prepaid interest that reduce your rate on most loan types. Points cost more upfront, but may make sense long-term to save on interest. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.

Comments

Post a Comment