JMMB Group Limited Equity Analysis

Table of Content

A definitive timeframe has not been indicated by the entity, but she shares plans are being put in place. Currently, JMMBMB’s first-time mortgage borrowers can access up to 80% of the market value or cost of the home or property, whichever is lower. He further indicated that the rate provided is variable, as it is subject to market conditions and is negotiable based on individual circumstances. Adjustable-rate mortgages, or ARMs, are mortgage loans that come with a floating interest rate.

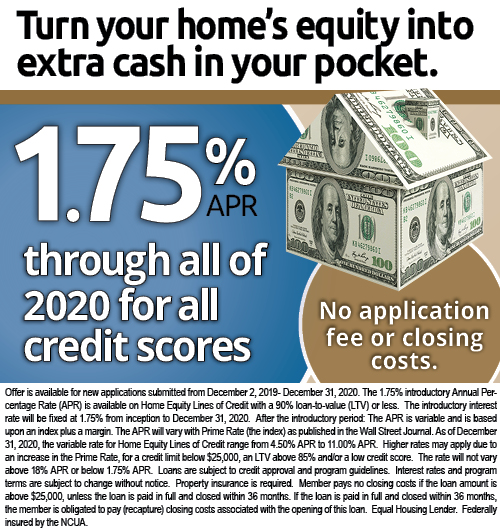

We do not include the universe of companies or financial offers that may be available to you. We are an independent, advertising-supported comparison service. There are no application or annual fees, or closing costs, but other fees may be charged when applicable. Find out your monthly car loan payment or your car purchase price with the Auto Loan Calculator from Farm Bureau Bank.

SBA loan rates 2022

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

Estimate your home’s current value by comparing it with recent sales in your area or using an estimate from a site like Zillow or Redfin. Be aware that their value estimates are not always accurate, so adjust your estimate as needed considering the current condition of your home. Then divide the current balance of all loans on your property by your current property value estimate to get your current equity percentage in your home. Home equity loans and HELOCs are both technically second mortgages on your home.

JMMB Group Limited | Equity Analysis

A HELOC is a revolving line of credit, much like a credit card, that you can draw on as needed, pay back, and then draw on again, for a term determined by the lender. The draw period is followed by a repayment period when draws are no longer allowed . HELOCs typically have a variable interest rate, but some lenders offer HELOC fixed-rate options.

New businesses have a high rate of failure, and risking your home to foreclosure isn't worth it if you have other alternatives such as a business loan or credit cards. Home equity loans provide an easy source of cash and can be valuable tools for responsible borrowers. If you have a steady, reliable source of income and know that you will be able to repay the loan, then low-interest rates and possible tax deductions make home equity loans a sensible choice. Fifth Third Bank offers among the most customer-friendly home equity loans with the ability to tap more of your home’s equity and a lower credit score requirement than most competitors.

What is a home equity loan?

For example, someone with a home that appraised for $500,000 with an existing mortgage balance of $200,000 could take out a home equity loan for up to $250,000 if they are approved. Though it is possible to get approved for a home equity loan without meeting these requirements, expect to pay a much higher interest rate through a lender that specializes in high-risk borrowers. Home equity loans are generally a good choice if you know exactly how much you need to borrow and for what. You’re guaranteed a certain amount, which you receive in full at closing.

At the current average rate, you'll pay $627.47 per month in principal and interest for every $100,000 you borrow. At the current average rate, you'll pay $635.36 per month in principal and interest for every $100,000 you borrow. Monthly payments on a 5/1 ARM at 5.46 percent would cost about $565 for each $100,000 borrowed over the initial five years, but could ratchet higher by hundreds of dollars afterward, depending on the loan's terms. At the current average rate, you'll pay principal and interest of $635.36 for every $100k you borrow. The central bank raised rates again at its November meeting — but what comes next is a toss-up.

For loans up to $250,000, closing costs are typically between $300 and $2,000. To arrive at our price target for JMMBGL, a Justified Price to Earnings (P/E) Model was used. Our estimate for the 2023 Financial year-end EPS, considering the challenges to operating profits in the first half of the financial year and seasonality of earnings amounted to $3.98.

The rate quoted above is good for a 10-year loan term, though you can borrow for terms of five to 30 years. The lower rate also requires automatic withdrawals from a TD Bank checking or savings account. The interest rates are reflected as annual percentage rates as of December 12, 2022. We also considered each lender’s combined loan-to-value ratio requirement, which is calculated by dividing the sum of all the loans on the property by its current value. Most lenders require owners to retain a CLTV ratio of 80% or less, but some are willing to go higher. Forbes Advisor compiled a list of the best home equity loan lenders primarily based on their starting interest rate, noting those that excel in various areas.

Additional terms and conditions may apply, depending on the type of collateral and other terms offered or chosen. Payment example assumes principal and interest payments for a [] loan segment with a 240-month repayment term, at a non-discounted APR of []. For well-qualified borrowers, the limit of a home equity loan is the amount that gets the borrower to a combined loan-to-value of 90% or less. This means that the total of the balances on the mortgage, any existing HELOCs, any existing home equity loans, and the new home equity loan cannot be more than 90% of the appraised value of the home.

You put down $30,000 when you bought it and since then, you have paid $30,000 in mortgage principal. That means you have $60,000 in equity ($300,000 home value minus $240,000 still owed). We’re happy to assist with a loan or mortgage to finance your goal. You may access up to 85% of the market value of residence or up to $15 million, whichever is less, and at an interest rate 8.5%. You’ve invested in your home, now it’s time for your home to return the favour. A home equity loan lets you use the equity you’ve built up in your home, as collateral.

Comments

Post a Comment